There are many differences between personal and business credit scores. One fundamental difference between consumer and business scores is the time frame the scores gauge someone’s risk of default over. A business credit score is a mathematical model that is used to depict a business’s risk of going 90 days late on an account within the next 12 months.

READ MORE

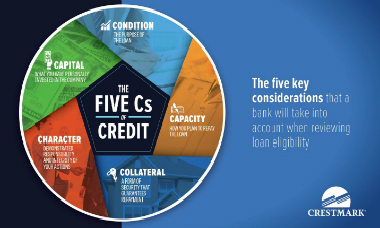

There are other factors that affect your ability to get credit, such as the amount of debt you already have, how heavily invested you are in your company, and even your personal credit can play a role in your approval or denial. Here we’ve covered five of them. In the end, the better the all-around picture you can paint, the better your chances of getting approved for loans will be.

READ MORE

Bank credit is the total amount of borrowing capacity a business can obtain from the banking system. Banks have their own internal way of scoring and rating businesses credit worthiness. They do this through a system called bank ratings, which rates the credit worthiness of a business from the bank’s perspective. A business can secure more business credit quickly as long as it has a minimum...

READ MORE

According to recent reports, as many as one third of applications for business loans are denied. If you find yourself as part of that group, there are some things you can do to help the situation. The first thing you need to do is try to determine where the problem is. Possible areas of concern may include:

READ MORE

If you are looking for money for your business than you will be happy to know you only need one “C” to qualify. In lending when we look to see if a client is fundable we are looking for one of the 4 “C”s. You don’t have to have all of the 4 Cs, only 1 to secure funding. The 4 Cs are:

READ MORE

Character is all about you. It’s about your personal history, your stability, and how reliable you are. This variable is more subjective than the others, and is one of several reasons it is beneficial to do business with a bank where you have built relationships with the people who work there. In determining your character...

READ MORE

The main credit score used in the business world is known as a Paydex score provided by Dun and Bradstreet. This number assess a business’s lending risk much the same as a consumer credit score reflects a consumer’s individual credit risk. Paydex is essentially the business equivalent of your personal credit score. READ MORE

A lot of people don’t understand the consumer credit system, and many more don’t understand the business credit system. Today I’m going to cover a couple of common business credit “myths”, and explain the truth that can be learned from them. READ MORE

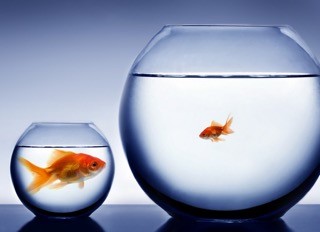

Imagine having the ability to access $50,000, $100,000, even $250,000 for your business. Now imagine doing this with NO personal credit check and NO personal guarantee. Your success in business will be determined based on your business credit profile and score. With a good business credit profile you will have near unlimited borrowing power. READ MORE